Technical Analysis – What is it?

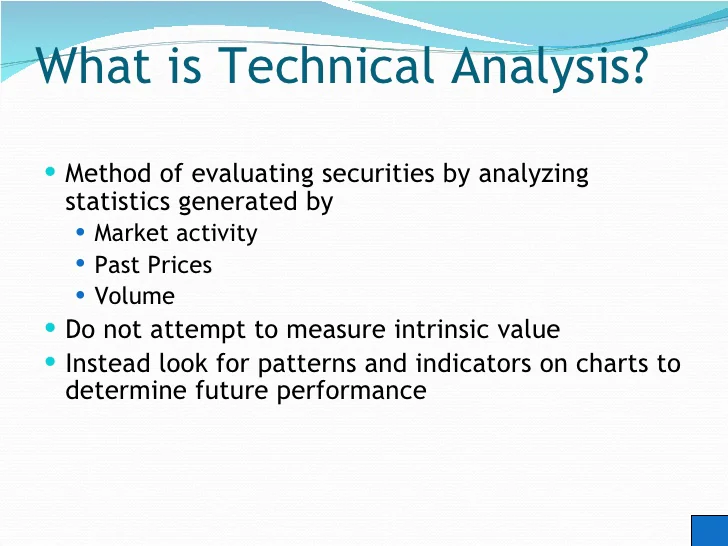

Technical Analysis is the interpretation of the price action of a company’s underlying stock (or any tradable financial instrument). Technical analysis is a tool, or method, used to predict the probable future price movement of security – such as a stock or currency pair – based on market data.

The theory behind the validity of technical analysis is the notion that the collective actions – buying and selling – of all the participants in the market accurately reflect all relevant information pertaining to a traded security, and therefore, continually assign a fair market value to the security.

Also Read: 5 Best Price Action Strategies for Beginners & Price Action Trading for Beginners in 2021

Let us understand Technical Analysis with the Example of a Cricket

If you are interested in cricket, then you will know that, whenever a player goes to play in a match, the team against which he is playing or on which field he is playing, then there is definitely talking about his past records and performances, and there is a possibility that, because that player plays well against that team or on that ground, then we express this possibility, That the player will still do something similar and show the game, as he has done before this, and you India and Pakistan in the WORLD CUP must have heard about the match played between that, India won against Pakistan.

Have won all their matches, the Cup match and this is the reason that whenever there is a World between India and Pakistan, then all the CRICKET EXPERT repeats this and expresses the possibility that this time also India will definitely beat Pakistan,

However, this is not necessary, no one can say 100% that the result will be exactly the same as it has happened many times in the past, but then it is emphasized that It is, that like last time the result of the match will be the same, and the truth is that this has happened at the moment, and after telling you that, Pakistan has not won from India in the WORLD CUP till date.

You should be asked that when the next WORLD CUP match between India and Pakistan is held, who will win?

So you must also say, although CRICKET is a game of uncertainty, still India has as many chances as possible, and now if you are asked to bet on this match, who will win? then surely most of you are in India. On the basis of all the previous matches and PERFORMANCE, it will be said that – This time also India will definitely win, and you will bet on India.

If we look carefully, knowingly, or unknowingly, we are making such a bet on technical analysis on the basis of only, that India will win.

Because the whole concept of TECHNICAL ANALYSIS is this, “HISTORY REPEATS ITSELF”

Exactly the same way, when it comes to buying or selling a stock in the stock market, that is, “HISTORY REPEATS ITSELF” when it comes to buying or selling a stock.

If we detect it by a chart, based on performance, history, that shares a sense of stocks, what in different conditions, and in view of the trend, it is nowhere can be found in the shares, how much up or how low, in such a way that study, is called TECHNICAL ANALYSIS.

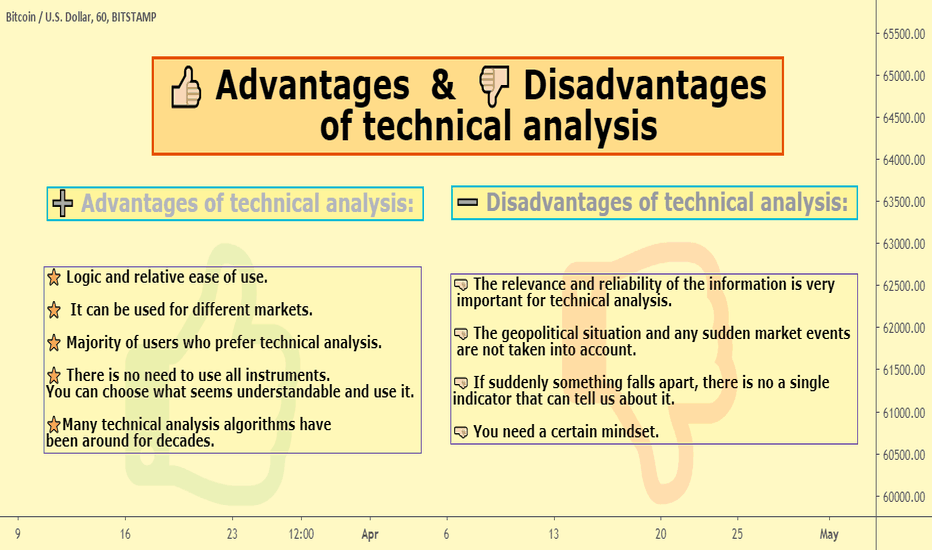

Advantages and Disadvantages of Technical Analysis

Technical analysis: Everyone in the market participates to make quick money while using technical analysis then this kind of the participant is known as Scalper or Day Trader.

They are those people who use technical analysis in different ways. Yes, some people see about the quickest money-making solution from this, which is quite possible.

People use technical analysis in different ways, some people use this method to make money as soon as possible. Let’s see about it, which is possible to a great extent, but for that, you should understand and implement Technical Analysis very well, and some people also resort to Technical Analysis to make more and more money.

Here it has to be said once again that Technical Analysis is a very good tool, to understand the direction of the stock market, and to confirm the deals, but for this, you should know and implement technical analysis properly.

Let’s come to Technical Analysis, Let’s take a look at some of the advantages and disadvantages of technical analysis in the below figure.

Whats is the Benefits of Technical Analysis ?

Benefits of Technical Analysis are as follows:

1. SHORT TERM TRADES

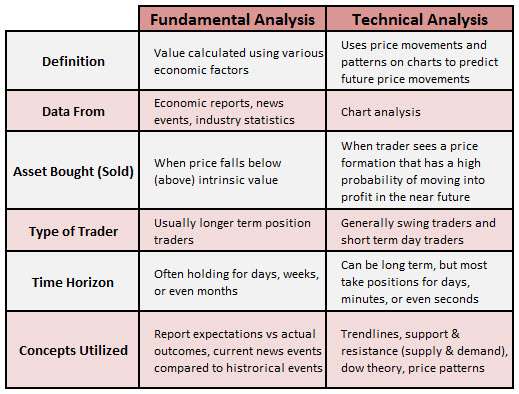

Technical Analysis is used to identify SHORT TERM TRADES, Technical Analysis should not be used to know about LONG TERM TRADE, FOR LONG TERM TRADER Fundamental analysis is much better.

However, a good investor will use fundamental analysis for a long-term trade as well as technical analysis for entry and exit in the market.

2. RETURN ON PER TRADE

Technical Analysis-based trades should not generally expect much profit but should keep taking small profits using Technical Analysis.

3. The HOLDING PERIOD

The time frame of trades done on the basis of technical analysis can be from 1 minute to few weeks, and Technical Analysis works well in the short time frame.

4. RISK

Based on Technical Analysis If there is a loss situation, then it becomes necessary to book the loss because otherwise it will be against the technology and the situation can become worse if the stop loss is not imposed.

In this way, you can understand how we can take advantage of Technical Analysis, and how we can make better deals with the help of Technical Analysis.

Also Read: How to Trade Central Pivot Range (CPR) Indicator in 2021 & Advance Day Trading Patterns for Beginners

VERSATILE USE OF TECHNICAL ANALYSIS

The biggest advantage of learning and understanding is that you use it, You can study any ASSET CLASS, if you have HISTORICAL TIME SERIES DATA for that ASSET CLASS, eg – use TECHNICAL ANALYSIS not only in STUDY of SHARE in STOCK MARKET, but in other CLASS of assets like COMMODITES, FOREIGN EXCHANGE, FIXED INCOME, and many more places you can use according to your advantage.

Here HISTORICAL TIME SERIES DATA means that you have changed in PRICE according to the time of that ASSET, CLASS and a REGULAR INTERVAL DATA is available, Like – DAILY, WEEKLY, MONTHLY, and OPEN, CLOSE, LOW, HIGH.

Fundamental Analysis vs Technical Analysis

In this way if you compare technical analysis with fundamental analysis, then technical analysis sees the biggest advantage, you use, but you can take advantage of using the same rules by studying other asset classes.

If you learn TECHNICAL ANALYSIS, then not only you can utilize technical analysis in the stock market but also in COMMODITIES MARKET, FOREX MARKET by applying these rules, you can find an opportunity to make some profit for yourself.

Learning technical analysis is exactly such that if you learn to operate one bike, then you can run almost every type of bike comfortably.

Whereas if you learn and learn FUNDAMENTAL ANALYSIS Talking about implementing, FUNDAMENTAL ANALYSIS is different in all ASSET CLASS, like – FUNDAMENTAL ANALYSIS of COMMODITIES MARKET and FOREIGN EXCHANGE is completely different as compared to FUNDAMENTAL ANALYSIS of STOCK MARKET, here you will get different ASSET CLASS According to different types of studies that have to be done.

In this way you can understand how beneficial it is for us to learn technical analysis, by learning a technique, you can use it in any number of places, and you can take advantage.

For this reason, TECHNICAL ANALYSIS is called a VERSATILE STUDY, which makes it a more interesting and fun subject.

Conclusion

With the help of technical analysis, we can know that when we should take ENTRY in the market, and when we should take exit from the market. Must be completed, in this way with the help of technical analysis, we are able to avoid that thing, due to which 90% of the people lose, and with the help of technical analysis, we understand that we should buy

- Which shares to buy?

- At what price should I buy the shares?

- How much to buy shares?

- When to sell shares?

- At what price should the shares be sold?

- How much did the shares sell?

- And how to control your loss in case of loss?

For more trading ideas do follow us on: