Swing Trading Strategy is one of the most reliable trading setups which will help you generate income on a daily basis. In this post, we are going to see how a common man can earn money from the stock market in only half an hour through swing trading.

I am not joking I bet you and challenge you anyone can make money from the stock market if you follow the rules and set them up properly.

So if you want to know how we can make money from the stock market within half an hour, you should read this post until the end without skipping any paragraph.

First thing if you are interested in learning the stock market and then earning, you are in the right place. The second thing is that person who is only interested in making money doesn’t want to learn things then you may leave right now from this post.

So let’s get started with the basics of swing trading.

What is Swing Trading?

Swing Trading is trading in which we can buy or sell instruments (scripts, commodities, cryptocurrency) within the period of 5 to 10 day those 10 days are known as swing trading.

5 reasons why swing trading is the best way to make money?

Swing trading is the best way to generate income from the stock market, reasons are as follows

- Regular Money.

- Fast Result.

- Improve Mistakes Quickly.

- Easy to Learn.

- Easy to Execute.

Regular Money

- Day to Day expenses can be covered by swing trading such as you can earn a regular income to pay your bills, EMI, etc.

- You will be your own boss and you can generate money on a regular basis.

- Flexible work when you get the time you can do your task with proper analysis.

Fast Result

- Quick money here you don’t have to wait for a long period.

- In swing trading within 1 day either will lose small or earn big profits.

- In investing you have to wait for a longer duration of time to earn money.

Improve Mistakes Quickly

- While trading or investing everyone makes mistakes, it’s a part of the stock market.

- Traders/Investors who write their journals can quickly take appropriate action on their mistakes and improvise them so they don’t repeat their mistakes regularly.

Easy to Learn

- Swing trading is very easy to learn. I will share with you the easiest and simple strategy.

- So that anyone can apply it and generate their income, to learn that strategy you need to read the whole post with patience so that you don’t miss any point of it.

Easy to Execute

- Similarly, like easy to learn, it’s very easy to execute. Also, I will convey how to take entry and exit in this system and also how to book profits and what should be the stop loss of this trade.

7 common mistakes in swing trading strategy

The seven most common mistakes in the swing are as follows:

- Using too many tools.

- Trading in the wrong time frame.

- Holding if the stock goes down.

- Trading on news/ events.

- Random trading.

- No Back tested strategy.

- Risk more than they can afford.

Using too many tools

- To become a professional trader, one must need their chart clean. So it will be easy for them to understand when to take entries and when to exit.

- If the chart is clean you can easily make your decision and execute it properly without even thinking of second thought.

- Whereas, if your chart is not clean which means you are using too many indicators then you won’t be able to take a proper trade because each indicator will show different signals at that particular time so you will be in a confused state.

- So it’s better to avoid too many indicators in your charts just follow one setup 100 times. I bet you will be one step ahead then newbie traders.

Trading in the wrong time frame

- Most of the newbie traders don’t follow the setups properly.

- If setup fails multiple times then they will try to improvise the setup by switching the time frames which costs them more because no setup will give you a 100% result.

- The setup works only 10% other 90% includes Money Management, Fear and Greed concept, and Trading Psychology.

- So try to follow the setup properly and don’t improvise the strategy often.

Holding if the stock goes down

- Keep strict stop loss in your system so that you can avoid your capital being drawdown.

- For example, if the stock goes in the opposite direction then you should be ready to give a small loss to the market.

- When the stock goes in your direction, be ready to capture bigger profits.

- Lose Small and Win Big which should be the motto of a trader to get rid of the market.

Trading on News/ events

- If you are going to follow this setup then you must avoid trading on news just do what setups convey you to do.

- Don’t try to mix this setup with any kind of news or anything, otherwise you will blow your account.

Random Trading

- Don’t do random trading, be an eagle in the market to take the right entry and exit while trading.

- Be a sharpshooter in the market whose aim is to hit the target rather than doing time pass.

No Back Tested Strategy

- I will give you the best swing trading strategy which I have back-tested and I believe in that strategy so I trade very easily with that strategy.

- So you need to do a backtest as well as a forward test so that you can believe in yourself. Yes, swing trading strategy earns my bread and butter on a daily basis.

- So for that first of all, you need to do trading with small quantities then after you can increase your quantity as soon as you become profitable.

Risk more than they can afford

- Never risk too much that you can’t afford or make any wrong decisions.

- Risk that much amount only so that you won’t get affected if you lose that amount.

- In trading or in any business we require a token amount to start so consider your risk as a token amount, if you lose that then it won’t affect you financially.

- Follow Risk Management Strategy, Fear & Greed, and Money Management Strategy to avoid big losses in the stock market.

Swing Trading Strategy for Beginners

Swing Trading Strategy is one of the most reliable trading setups which will help you generate income on a daily basis. This strategy will help you in analyzing stocks very easily I will convey to you in following steps:

What is Swing Trading Strategy?

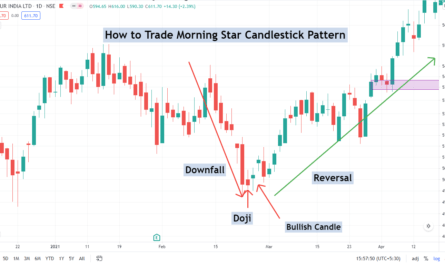

Swing trading strategy is a strategy that allows you to find stocks very easily using one indicator that is Simple Moving Average as shown in the below chart.

You need to find those stocks which is nearer 50 Day simple moving average and note down those stocks, you need to use daily time frame for this strategy don’t try to become oversmart otherwise it will you cost you more.

Just follow what I convey you to do here so that you can become a profitable trader.

How to analyze the stock?

Stock selection on weekend, first of all we need to find those stocks which are rising to 50 day moving average as well as nearest to our moving average and then we need to just focus on those stocks through the whole week.

How to take entry in stock?

As the stocks touch our 50-day moving average and then if it forms a bullish candle then we need to place our buy positions order above the bullish candle.

What should be the stop loss in this swing trading strategy?

Stoploss should be the previous 2 days low of the candle in this trade.

What should be the Target?

Target should be the minimum 1:2 risk-reward ratio which will be helpful for you to become a profitable trader in the upcoming days because no strategy works `100 % in the stock market. So risk-reward ratio will help you grow your trading account in future.

Conclusion

Swing Trading Strategy for day trading is usually the best trading strategy to take the trade. This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can enter your positions. Stoploss should be the low or high of the inside bar candle for uptrend and downtrend and the target would be as per your risk-reward ratio. One should follow the Risk Management, Money Management, and Fear and Greed concept of the market to avoid big losses.

if you like this post kindly leave a comment in the comment section so that we can know what your thought about this swing trading strategy. For more trading ideas do follow us on