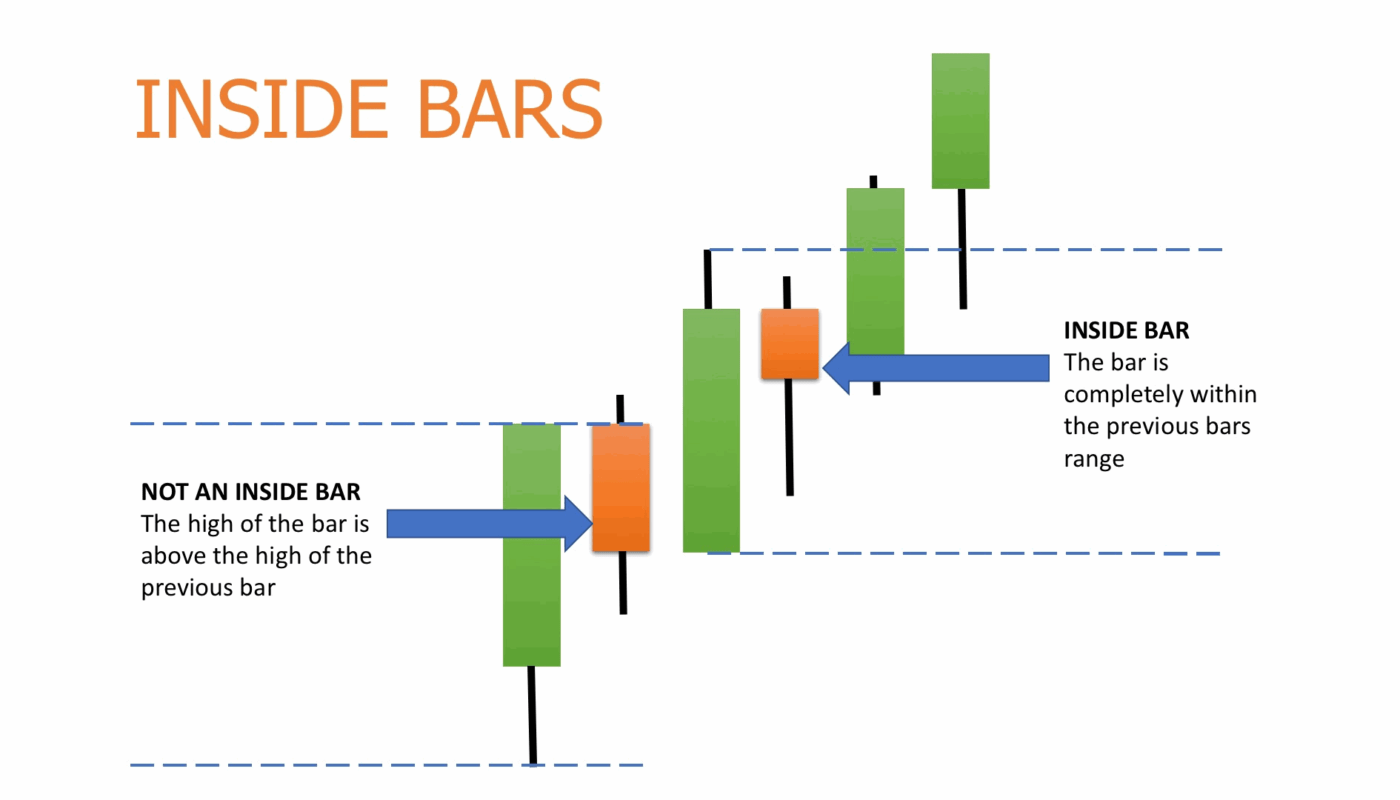

Inside Bar Candle also has two candlestick patterns and here it’s exactly flipped around the opposite way.

The first candle is usually the large one and in the second one falls into the range of the previous one so the second candle is inside of the first candle and it means that the market is slowing down the momentum is going down and we can use it across various trading strategies.

I have covered three strategies to cover a really broad spectrum of market actions. First let’s recap what is engulfing bar candles and outside bar candles.

Both the inside bar and outside bar are true pattern candlestick formations so we need at least two Candles to find this pattern and when you look at the outside bar it’s also called an engulfing bar.

The first candle is very very small or smaller and the second one is completely engulfed and it’s completely outside of the range of the first candle.

This can be a Momentum candle. It is often a reversal sign and it can also be used for break out and continuation trade. so very versatile and a very very important candlestick.

So three strategies of inside bar candle are as follows :

Reversal Inside Bar Candle Strategy

Reversal we’re going to look for the slow down and then expect an explosion in momentum so here we have the first example that we can find inside and outside bar candles all over the market.

But to really make sure that you are better at screening Markets and then you are increasing the chances of finding high probability trades in the share market.

We want to look for Candlestick Patterns information that has happened first of all along a trending period so we are going to stay away from range markets.

We are going to look for them and as breakout points and we are also going to look for them around important support and resistance levels.

So here we have a strongly downwards trending market then here we have huge bearish candles and the market has completely died down.

There was no Momentum afterwards. You can see those three four five can fall in the range of the previous one and especially those two here to right after the bearish candle.

You expect more follow through because of these two signals, lots of selling pressure but didn’t. The market has completely died down and this is a sign that the sellers are not as strong as this candle may make it look like.

This is not going to be a very very strong selling market so if you are at a short position then you should think about exiting your trades and then you can start looking for trades in the opposite direction.

Trend Continuation Inside Bar Candle Strategy

Trend continuation you could use moving average to get a clear trend of the stock market.

For example, we could use a moving average to help find or determine the current direction and what you want is that the market is trending on one side of the moving average and then as the trend continuation trader you need to wait for consolidations or pullbacks period.

Then those continuation and pullback you want to wait for Momentum again into trend direction so that you can see after this break out the market will go in their trend and then slow down.

Inside Bar Candle shows that this is just a consolidation but also there is not a lot of selling pressure and suddenly the market shoots up and makes another high and then continues.

This is a very very classic move. We have impulsive moves of more than small consolidation and then a continuation that would trigger with an outside bar.

Breakout Buildup Inside Bar Candle Strategy

Breakout Buildup is one of my favourite set ups. What you have is usually a trend that loses strength than market trades within a pattern that is double bottom or double top.

It can be head and shoulder and you have a very well defined support resistance usually and before breakout into the new trend.

its signals that the market moved into the level and was previously the market sell off strongly away from the level.

Now the price really stuck to the level and I was not aware of selling pressure and then once the Breakout happens we can put this all into context and identify high probability breakout opportunities.

Conclusion

Inside Bar Candle patterns for day trading are usually a best trading patterns to take trade. This setup is very easy and simple to use just you need to keep patience and let your setup to form and then you can enter your positions. Stoploss should be the low or high of the inside bar candlefor uptrend and downtrend and the target would be as per your risk-reward ratio. One should must follow the Risk Management, Money Management and Fear and Greed concept of market to avoid big losses.

if you like this post kindly leave a comment in the comment section so that we can know what your thought about these candlestick patterns. For more trading ideas do follow us on