Welcome back to Traders Ideology, In this article, we’ll do the fundamental analysis of Maruti Suzuki where we’ll cover its business profile leadership key strengths competitors, and future growth and then we’ll cover the financials of the company, finally we’ll conclude if Maruti Suzuki is fundamentally strong or not.

When we talk about a commoner’s car in India, which would be the first name that pops into your head? It would be a Maruti 800 It was more popular with the name Maruti.

People used to say that they want to buy a Maruti instead of a car. The car and the company have become more of sentiment for the people of India. This was one of the first cars in India.

Introduction

- Maruti Motors was incorporated back in 1971 with Mr. Gandhi as its first Managing Director.

- It was Mr. Sanjay Gandhi, the younger son of Mrs. Indira Gandhi who was responsible for bringing the ‘People’s car’ – a vehicle that had to be cheap, affordable, efficient, and, more importantly, indigenous to the people of India.

- He started Maruti and became its Managing Director.

- The journey of Maruti Motors saw many ups and downs.

- It faced heavy criticisms along the way and had to be liquidated once.

- But it rose from the ashes and rebranded itself as Maruti Udhyog.

- Later, the company joined hands with Japanese multinational – Suzuki Motor Corporation

- It got technology that it received straight from Japan. And in this way, friends, Maruti Suzuki was born.

Stock Performance

- If we talk about the Stock Performance since it got listed on BSE, Maruti Suzuki has given a whopping 50x returns and a 21% CAGR return over the last 10 years.

- Clearly, it has been one of the biggest wealth creators in the Indian stock market

- Over the period, the company has not just beaten the sectoral index, but also the benchmark Sensex.

- It has outperformed and given good returns to its investors.

- I discussed the past 10 years returns.

- But if you look at the last 5 years, we can see that the company has delivered a muted performance of 3% CAGR returns.

- However, if you look at the recent rally starting in early March of this year, the company has been gaining momentum.

Fundamental analysis of Maruti Suzuki

The fundamental analysis of Maruti Suzuki is as follows:

Maruti Suzuki Business Model

- The company’s main business is, of course, car manufacturing, purchase, and sales. I will try to explain all factors which are inside it.

- Currently, the company provides sales services through its two dealership channels, Maruti Suzuki Nexa & Maruti Suzuki Arena.

- But why two different channels, you might ask? There is an interesting point behind it.

- The company was working well in the affordable sector where it had a good market share.

- It felt it was lagging in providing customers with a premium experience.

- To give this premium service, they brought Maruti Suzuki Nexa.

Maruti Suzuki Nexa and Arena

- Let’s know about Maruti Suzuki Nexa and Arena in detail.

- They have tried to leverage the power of digital technology at their Arena showrooms, where the customers can personalize their vehicles using the company’s website.

- Whereas Maruti Suzuki Nexa is a channel for selling premium Maruti Suzuki cars. The prices are a bit higher.

- In addition to the above channels, the company also has a resale platform where one can buy or sell pre-owned cars from their True Value showrooms.

- This company is also in the business of selling motor vehicle components, accessories, and spare parts.

- We talked company-specific but now let’s talk about the industry.

Automobile Industry

- The Indian automobile market is very much attractive to foreign players.

- There are around 15 players in the 4-wheeler automobile segment.

- According to a National Family Health Survey (NFHS) report, only 8% of Indian families own cars.

- That means only 1 in 12 families owns a car.

- So 50% of people use bikes, scooters, or bicycles.

- This makes India very much an attractive destination for major global players.

- For many years, Maruti has had a healthy market share of around 50% in this segment.

- This means that every 1 out of 2 cars sold in India is of Maruti Suzuki make.

- One can think of many reasons for this.

- Some might say mileage and for some, it is the after-sales services, while for most it is – “COST”.

- Maruti Suzuki gave cars for less cost so people could afford them.

- if 100 cars are sold in India, only 5% of the cars sold in India are priced at Rs. 15 lakh or more.

- So 95% of cars in India are sold for under 15 lakhs.

- So Maruti Suzuki has a good share in the affordable automobile sector.

- The concern here is that it enjoyed a 50% market share which is declining continuously now.

- It led to a declining market share to 43.4% over FY19-22.

Company Financials

- Now let’s talk about the numbers of Maruti and other competitors in the market.

- In an article in Business today, they told about auto sales.

- The topmost is Maruti then Tata Motors, Mahindra & Mahindra, and MG Motor.

- Now let’s talk about investor-specific things and how Maruti performed in Q4 results.

- This is a pie chart which tells you about sales volume.

- The company clocked 4,88,830 in sales volumes, a sharp increase of 13.5% compared to the previous Quarter.

- Maruti Suzuki grew its exports by a staggering 93%,

- Compact- 55%, UVs- 18%, Mini- 13% and others

- The company increased its net revenue in the Quarter by 15% sequentially from the 3rd Quarter.

- On the margins front, the company announced an Operating margin of 7%.

Shareholding Pattern

- Now let’s see the shareholding pattern, investments, and promoters’ stake in Maruti Suzuki.

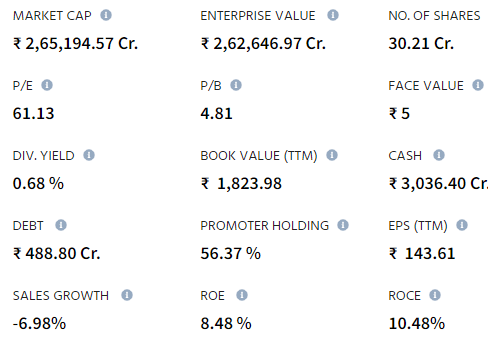

- As you can see that promoters have the highest stake with 56.37%

- FIIs- 21.89%, DIIs- 18%, Retail investors- 3.73%.

ROE

- Now let’s talk about return on equity i.e, how much the company makes returns on its equity investment.

- You can see the formula on the screen and below it, I am showing 10 years ROE which is strong at 11%.

- 5 years- 9% 3 years- 6% Last year- 7%.

Key Challenges

- Let’s see the company’s key challenges in the coming future.

- If 100 cars are sold in India, 80% are sold on financing i.e, loans.

- With the increasing interest rates, we can expect a decline in sales as the financing might get costlier.

- The company has an order book if fulfilled then it can increase its market share.

- But there is a concern about semi-conductors.

- Due to the semiconductor shortage, there are delays.

- If the company improves all this, it can grow better in the future.

Future Growth Prospects

- Let’s discuss the future plans of the company.

- The company has lost market share recently, and the main impact was seen in the SUV segment.

- Recently the company launched a refurbished version of its popular compact SUV model Brezza.

- The company can bring products to tap this market.

- The company will bring 4 new models under the SUV brands

- As an investor, it is important for you to check the company’s improvement in the SUV sector and acquire market share.

- The company’s performance will impact the revenue and hence prices as well.

- Apart from this, the company also has plans related to foray into the Electric Vehicle market.

- You must have heard about Tata.

Will Maruti Suzuki make a good investment in EVs?

- The parent company Suzuki will invest Rs 10,445 cr for manufacturing EV batteries in Gujarat by 2026.

- From this, ₹3,100 crores will be used to increase EV manufacturing capacity while ₹7,300 crores will be invested to start making batteries

Valuation

- Let’s discuss the company’s valuations and also what experts say here.

- The company is trading at a PE ratio of 65.43, the highest among its peers.

- This shows there are high expectations from the market leader.

- In Motilal’s article, experts expect the company to perform well in the future.

- And the company’s market share can improve from 6% to 49%.

- This is Motilal Oswal’s view which we are telling you for educational purposes only.

For more trading and investing ideas do follow us on: