In this article, we are going to learn about how to trade opening range breakout strategy and how to select stocks in this strategy in three simple steps. Now, in this series, we will be learning about intraday trading strategies and short-term trading in detail. Now, I’ll be showing you three simple steps which will help you execute trades based on the opening range breakout strategy.

I have also included three new concepts on how to use relative strength, volatility, and volume to increase the odds of success. Again, this strategy is extremely simple and this is something you can learn today and start practicing it from Monday. So let’s get started.

opening range breakout strategy

Now, an opening range breakout strategy is a fairly simple strategy that involves taking a position when the price breaks above or below the previous candle high or low. This can be used for different timeframes depending on your own preference.

The opening range is simply high and low of a given period after the market opens. This period is generally the first 15 minutes or 30 minutes of trading. During this period, you want to identify the high and low for the day. Once the high and low are identified, you then wait for the price to move above or below this range.

And once this happens, you go ahead and initiate the trade in the direction of the price move. You will have to use some filters and rules in order to increase your odds of success in this trading strategy. This is mainly because markets have indeed evolved and changed in some ways as technology has made access to markets a lot easier. Change in the market is mainly in front of volatility and how this strategy is affected due to this main reason.

How a range is defined?

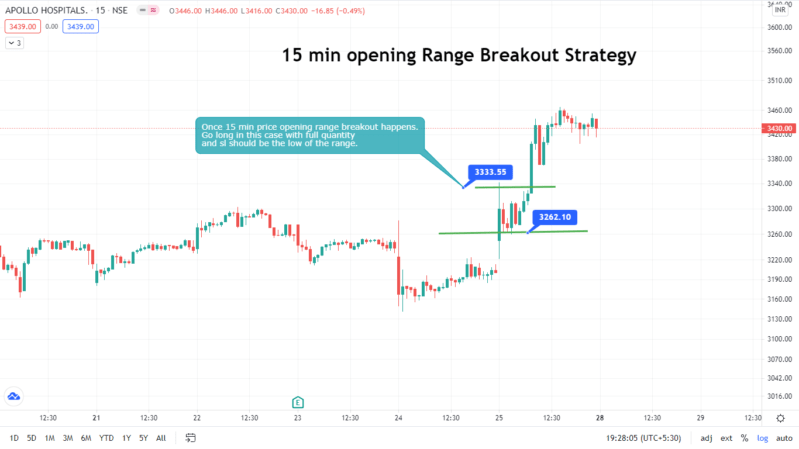

Let us see how a range is defined here. In the opening range breakout strategy, the range is defined in a very simple manner. In the above chart, this candle that you see here is a 15-minute candlestick pattern. For identifying the opening range, you simply need to draw a horizontal line at the highest point and a horizontal line at the lowest point of the candle.

This now becomes the opening range for the day. If the price moves above or below this range, you initiate a trade-in in the direction of the price move. Opening range breakout is always easy to trade in hindsight. In real-time though, you have to remain focused and not react to every move price makes. Your biggest hindrance in becoming a successful intraday trader your own mind. Keep it in check and keep it focused in the current moment.

There will be times when you will get loss in this strategy and it is during these times that you will begin to think that this does not work anymore. To improve on this, focus on the process of execution and do not focus on profit or loss. In the long term, this simple approach will help you a great deal in executing this strategy.

Time frame for opening range breakout strategy

Let me now come to the time frame for the opening range breakout strategy. Now, every trader has a different preference for the time frame and this is totally fine. The most common timeframes opening range breakout is 15 minutes and 30minutes timeframe.

For our markets, I have found a 15-minute timeframe to be really effective, especially if you choose to between trade index futures and high beta stocks futures. One suggestion that I will give is that don’t be afraid to experiment with timeframes.

Concepts across the timeframes remain the same and hence you need to find the timeframe that suits you the best. I would also encourage you to first select two to three stocks for this method and practice this till you get some experience.

To add to this, I will also suggest that first trade on the long side for about six to eight months before attempting to trade this on the short side. Choice of the instrument should be equities only and once you gain some experience, you can then try stock futures or index futures.

Why opening range breakout fails many times?

Let me now explain why opening range breakout fails many times. In this chart, these two points are the opening range for the day. At this point, the price crosses this level and most of the traders would go long. But look what happens to price. Price soon reverses and then moves lower with momentum.

As a matter of fact, opening range breakout works 40 to 45% of the time without applying any filters. However, with the three simple steps that I will show you, you can increase the odds of success above 60% and even 65%. When this concept was introduced by Toby Crabel, market participants were limited, and more importantly, lack of technology meant traders would not have to compete with algorithm-oriented trading.

This in fact has had a huge role in why opening range breakout usually fails so much. There are times when this works exceptionally well and I’ll be showing you how to identify such specific periods.

Even though we are competing against high-frequency traders and trading algorithms, opening range breakout is still a very powerful trading strategy. I will advise you to be realistic with this though.

Keep expectations of profits real and do not expect every trade to be successful. I would also strongly advise you to read TobyCrabel’s book on this. I don’t know if you can buy this online, but do check for the same.

Most Important Concepts in opening range breakout

Let me now come to one of the most important concepts in opening range breakout. This is something I have observed with my own experience. In simple terms, most of the wide range candles that you see on the daily timeframe chart are either a variation of opening range breakout or variation of range breakout that we saw in the previous post.

If you look at this chart in front of you, this wide range candle that you see is of daily timeframe chart. This candle is a result of all these 15-minute candles that you see here.

This means, by anticipating when a stock is more likely to form a wide range candle on a daily timeframe chart, it is possible to spot opening range breakout trades on a 15-minute timeframe chart. In the entire framework of opening range breakout, this is a very vital step as this becomes one of the main data points to consider while selecting stocks for this strategy.

Do note that all the stock steps that we discussed a couple of posts back do apply here as well. In case you have missed that post, I will leave a link towards the end of this post.

How To Select Stocks in Intraday Trading

Let us now come to three simple steps that will help you select stocks as well as trade this strategy successfully. You can even include concepts from the previous range trading strategy posts.

The first step here is to assess the volatility cycle of the stock. This is done on a daily timeframe chart using a simple ATR indicator that is available across all technical platforms.

Now, for those of you who don’t know, ATR is an Average TrueRange Indicator. If you look at this chart, as the average true range for stock moves higher, look at how many wide-range candles we get on the chart. Till the point volatility does not begin to fall, there are a total of 2 to 3 wide range candles on a daily timeframe chart. After the volatility cycle begins to fall from this point, you get just four wide-range candles.

Most of the candles marked here are narrow-range candles with very limited movement. To be successful in opening range breakout strategy, you need to be only those stocks that are clearly exhibiting upcycle in terms of volatility. This way, you will increase the odds of success a great deal.

As volatility contracts, arrange of stock contracts as well and as intraday traders, this is something we should not prefer.

Relative strength of the stock

The second step is to check for the relative strength of the stock, that is its performance against a broader market index like Nifty or S&P 500. Relative strength rules for opening range breakout strategy slightly different from what we saw in the previous post.

Therefore, do pay attention. On a daily timeframe chart, we need to check for relative strength line trends. To get the relative strength line, you have to divide the price of a stock from the price of the broader market index. You need to make sure that the relative strength line should be clearly sloping on the upside in case you are willing to take long trade in the stock.

On the flip side though, if you are willing to short sell, then you should focus on stocks where the relative strength line is sloping on the downside. Now, this means that you will trade only those opening range breakout strategy on the long side where the relative strength line is clearly sloping up. And you will also trade only those opening range breakouts on the short side, where the relative strength line is clearly moving lower.

There is one more element you have to combine with relative strength that we did not cover in the previous post. And this is the concept of combining volatility with relative strength. So in this chart, the upper sub-panel is volatility, and the lower sub-panel is that of relative strength. You have seen in the first rule that we only target those stocks where volatility expansion is at play.

Now with relative strength and volatility together, here are the two rules that you have to follow.

Rule Number One: trade opening range breakout when volatility is expanding and relative strength line is either rising or falling. That is, a stocks out-performing or underperforming as its volatility cycle is expanding.

Rule Number Two: when volatility is not expanding, avoid trading opening range breakout strategy even if the relative strength line is rising or falling. I hope these two rules are clear. So in this chart, I will trade opening range breakout in the stock when volatility is rising and stock is out-performing. I will also take trades when volatility is expanding and stock is underperforming.

However, I will not take trades when volatility is contracting and relative strength is either rising or falling. This is something we did not cover in the previous post on range breakout trading and this adds an extra dimension to using relative strength in trading opening range breakout.

Volume Tracking

The third step that we have to consider is tracking volume concerning its recent averages. Now, in the previous post, we discussed that as price moves up and down, volume expansion should happen, and as a trader, we must focus upon taking only those trades where this is visible. Now, while this rule is applicable in this strategy as well, let me show you

How to read market participants interest in a particular stock.

I have observed that before move or down move in the stock, the volume begins to increase way above the average volume levels seen over the past 10 days. In this chart in front of you, there is two opening range breakout strategy that I’ve marked here. Both of these breakouts have worked well. Now before this, look at what happened to volumes.

Volumes did not see any pick-up in this phase. And then suddenly, volumes clearly started moving above the average volume range seen in recent times. Whenever you see this happening over one to three sessions, start including stock in your watch list.

This is a clear sign that traders are interested in the stock and hence, you will see the stock move quite a bit on an intraday basis. Most of the profitable opening range breakout strategy trades come when such volume activity is spotted. I have seen more of these in stocks than in index futures but the underlying principle remains the same.

Before we get to entry, exit, and stop-loss, let me first show you how you can identify a strong opening range breakout strategy. In this chart, I have marked out pivot level along with support, S1 and S2, and resistance, R1, and R2. Now, this is done using the standard pivot point formula.

So in my own trading, when I spot opening range breakout happening way above the R1 or R2 level, I skip taking the trade. Instead, I wait for the price to pull back, and then I prefer to enter.

In this chart, look at this region. This is where the price gapped up above the R2 level. That is Resistance 2 level. The price moved higher and did not pull back much and hence, I wouldn’t attempt to trade this particular stock. If you look at this region instead, the price gapped near the R2 level, that is the Resistance 2 level, and then it did pull back between the pivot and R1 level. And hence, this is one of the trades that I would consider taking up.

In these two cases that I’ve marked on the chart, the initial opening range is near the pivot level and between the pivot and R1 level. Now, these are the trades I will prefer more as the price still has a lot of scopes to move higher. When the gap is too large, I refrain from trading or move to another instrument.

What I have observed is that opening range breakout near the pivot level is more likely to succeed than when the price is opening above or near that Resistance 2 level. In such cases, the odds of mean reversion remain high. Another way to identify strong opening range breakout is by studying where the breakout happens concerning high volume nodes.

A high volume node is where maximum trading activity and volumes exist in that particular time range. This is an important region to track price action. A strong opening range breakout would be one where the price above these high-volume nodes. If price breakout and stand a high-volume node exists right above it, I would circumspect of taking the trade. If you look at the above chart, this opening range breakout has happened above these two high-volume nodes.

This signifies resistance going ahead and the price is much betterer position this way to trend higher. I am more inclined towards taking breakout trades. if the price is clearly above the high-volume node. I have observed that trend is much smoother and even momentum in such cases remains strong.

If you look at the above chart, the opening range breakout strategy happens in this region here. Look at where high-volume nodes are on the above chart. As the price moved higher from this breakout point to this level, the volume node has shifted to this particular region.

Now, the opening range forms exactly at this volume node, and then the price moves higher with a clean breakout. If you mark out this breakout level, it has clearly happened above this high-volume node region. As an intraday trader, try and look out for such instances where the price is clearly above the high-volume node regions.

Now, I have covered the volume node in a separate post, and in case you have missed it, I will leave a link towards that towards the end of this post. Let us now move to two more important filters. Let me now explain the relevance of opening range breakout with NR4 and NR7 patterns.

These were concepts discussed in Toby Crabel’s book. NR4, which is Narrow Range 4, is made up of four candlesticks The most recent candle will have a range that is much smaller than the three previous candles. This indicates volatility compression and it is usually a point from where price moves with momentum. NR7 is Narrow Range 7, it is made up of seven candles.

The most recent candles will have a range that is much smaller than the previous six candles. This also indicates volatility compression and this is stronger than the NR4 pattern. What I’ve found is that when a stock forms NR4 or NR7 the and next day, the price exhibits an opening range breakout pattern, then odds are high for trade being a profitable one.

The narrow range represents volatility contraction the and opening range breakout exhibits volatility expansion. Both these concepts, you see, fit perfectly together and hence this is one of the most important filters in the opening range breakout strategy. If you look at the above chart, I have marked out NR7 and NR4.

Look at how many wide-range candles form once price completes these patterns. This is the main reason why tracking this consistently is so important for an opening range breakout pattern. You do get to know which stocks are more likely to move and hence you can select these stocks for this particular strategy.

Now, another filter that you’ll see is VWAP. Now, VWAP stands for the volume-weighted average price and this remains one of the most popular indicators for intraday trading. VWAP is used for two main reasons. Number one, to get a sense of intraday trend, and number two, to know average price based on volumes.

If the current price is below VWAP, then the trend is considered down, and if the current price is above VWAP, then the trend is considered as up. Now, VWAP is a vast subject and I cannot covert this in this video. In the comment section, let me know if you guys are interested to know about VWAP.

Based on your response, I will make a series on this. From the opening range breakout point of view, I have observed that some of the strongest breakouts happen just in the VWAP region. This makes sense as well as the VWAP region is kind of a neutral region in the market and buying and selling usually emerges in and around this region.

If the breakout happens way above or way below the VWAP level, it is always better to avoid those trades.

How to take Entry and Exit in Opening Range Breakout Strategy

Let us now come to the section of entry and exit. Entry is pretty straightforward in this strategy. Although, there are a couple of variations that play out depending on underlying market conditions.

So, the first case marked here on the chart is where I will avoid taking the trade. Price here has opened with a gap of more than 2.3% and hence there is no point taking a trade here.

In this second case, the price has gapped up by 1.2% and here I will wait for a pullback to happen before attempting to take a trade. Any gap which is greater than 1% should not be chased.

Let the price pull back and only then enter the trade. The remaining two cases here are pretty straightforward. On both occasions, the price moves higher after the first 15 minutes and it becomes your entry point. Stop loss for the trade can be the nearest pivot points on the chart and I have marked the same for your own understanding.

Let us now move to exit conditions. As we discussed in the previous post, if the advance decline is really strong, let your positions continue till the end the of day. If you don’t get strong advance-decline readings, then use ATR to estimate the probable move in price.

For calculating average true range data over 50 periods on a15-minute timeframe chart. In this case, the average true range over 50 periods is rupees and rupees 10 respectively. Therefore, the probable move can be calculated as high of range plus three times ATR value.

For the first case, this would be rupees1,650 plus rupees 24, that is rupees 1,674. And for the second case here, this would be rupees1,720 plus rupees 30, that is rupees 1,750. Do know that is just an approximation but it does work very well. Now, this strategy, if you see, is fairly simple to learn and implement on a day-to-day basis.

It is just that initially, you will lot of doubts about this. I strongly encourage you to ask your doubts in the comment section below no matter how basic it is. I personally each comment that is posted.

Conclusion

Opening Range Breakout Strategy for day trading is usually the best trading strategy to take the trade. This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can enter your positions. Stoploss should be the low or high of the inside bar candle for uptrend and downtrend and the target would be as per your risk-reward ratio. One should follow the Risk Management, Money Management, and Fear and Greed concept of market to avoid big losses.

if you like this post kindly leave a comment in the comment section so that we can know what your thought about these Opening Range Breakout Strategy. For more trading ideas do follow us on